Post 3/3: ✅ A Smart Way to Stop Revenue Leakage

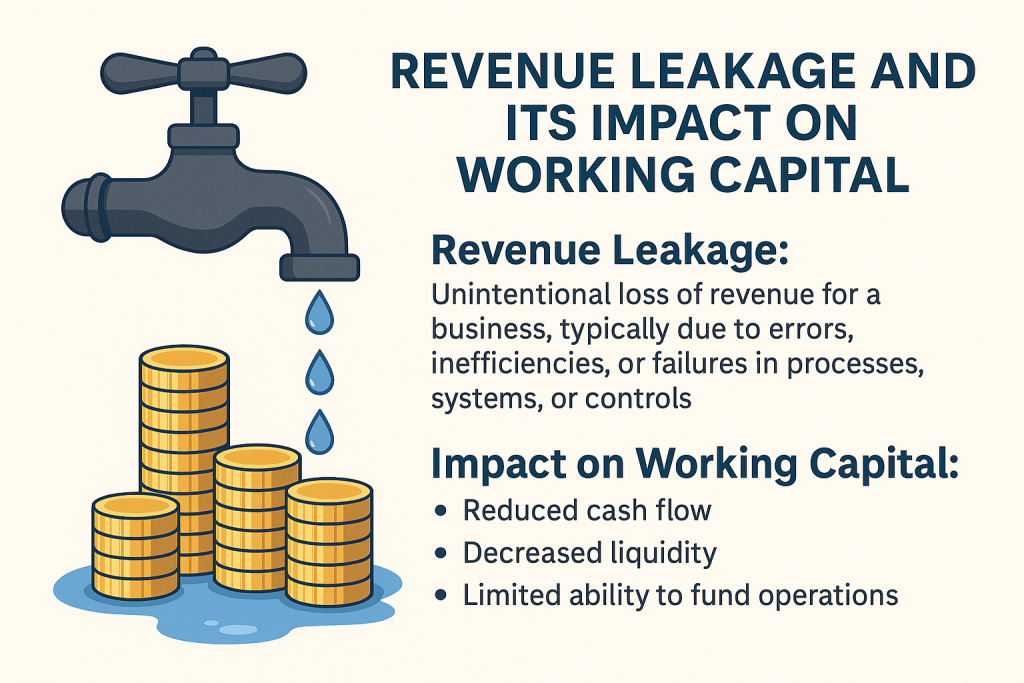

The solution is to check every single job? Or automate the checking processes? FALSE. This is likely to flag too many jobs creating a very long list of false positives, overload the system, the user, and alert fatigue would set in.

Forget rule-based automation that fails due to inconsistent charge codes. We took a different route: filter by gross margin outliers.

📊 Step-by-step:

- Track job-level revenue, cost, and gross margin %. Create a list of averages by service and tradelane.

- Flag jobs with margins far below (or above) average (outliers)

- Deep-dive review only for flagged jobs

- Investigate unbilled services like customs inspection, port storage, etc.

- Tag root causes for recurring process gaps

- Perform period spot checks, especially for vendor rebates and recent cost renegotiations.

This approach works – it’s scalable, data-driven, and minimizes false positives.

Want to tighten your billing accuracy? Start with your margin outliers.

And BTW, a list of averages will help operations with monthly forecasting.

#RevenueLeakage #FreightERP #OperationalExcellence #BillingControl #MarginManagement #WorkingCapital #LogisticsFinance #FreightForwarding #Profitability #BillingErrors #SupplyChain #ProcessImprovement #mmlogistix